The potential of the digital economy in Southeast Asia is enormous. Factors such as a significant demographic dividend, increasing penetration of smartphones and the internet, and the growing middle class highlight Southeast Asia as a major and undeniable emerging market today.

Recently, Google, Temasek, and Bain jointly released the latest version of the “2023 Southeast Asia Internet Economy Report” (“e-Conomy SEA 2023”).

The report shows that, compared to other regions in the world, Southeast Asia has withstood the headwinds of the global macro economy and exhibits greater resilience. In 2023, Southeast Asia's GDP growth remains above 4%, making it one of the fastest-growing regions globally, surpassing developed markets such as the European Union and the United States."

Summary of the Core Viewpoints in the Report

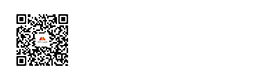

1. In 2023, the GMV (Gross Merchandise Volume) of the Southeast Asian digital economy is expected to reach 218 billion USD.

2. In 2023, the Southeast Asian digital economy is projected to achieve revenues of 100 billion USD. Since 2021, the income of the Southeast Asian digital economy has grown at a compound annual growth rate (CAGR) of 27%.

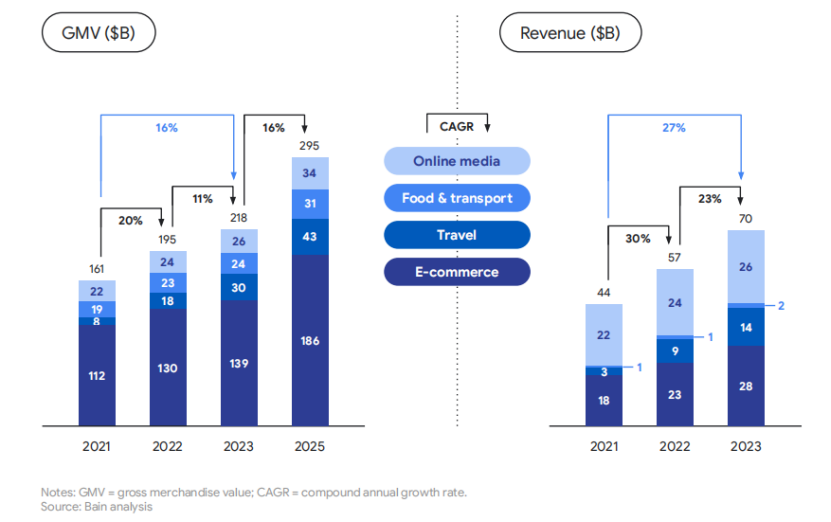

3. Indonesia remains the most prominent digital economy in Southeast Asia, and it is expected that by 2025, the GMV of Indonesia's digital economy will surpass the hundred billion USD mark.

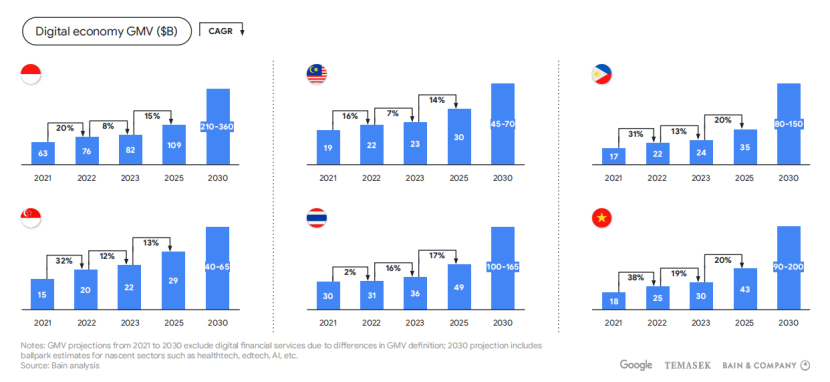

4. The GMV of the Southeast Asian e-commerce market is estimated to reach 139 billion USD in 2023, and it is expected to increase to 186 billion USD by 2025.

5. The rise of digital payments. Digital payments in Southeast Asia account for over 50% of the region's transactions.

In this issue of #SoutheastAsiaVentureCapitalTruths#, we will interpret the "2023 Southeast Asia Internet Economy Report" (hereinafter referred to as the report) from the perspectives of the Southeast Asian digital economy, high-growth countries, and potential tracks.

Southeast Asia Digital Economy: Total GMV Reaches 218 Billion USD, Indonesia Leads as the Largest

According to the report, the Southeast Asian digital economy's GMV is projected to grow at a compound annual growth rate (CAGR) of 11% to reach 218 billion USD in 2023. By 2025, the GMV of the Southeast Asian digital economy is expected to increase to 295 billion USD, with a CAGR of 16%.

The income growth in the Southeast Asian digital economy has reached a significant milestone, with the combined income of all digital economy sectors projected to reach 100 billion USD in 2023, marking an eightfold increase over the past eight years.

Breaking down into specific sectors, e-commerce, tourism, online media, and transportation contribute a combined income of 70 billion USD to the Southeast Asian digital economy. It is anticipated that the tourism and transportation sectors will experience a full recovery in 2024 and continue to have further growth potential.

Looking at individual countries, thanks to its large population, Indonesia remains the largest digital economy in Southeast Asia. According to report data, Indonesia's digital economy GMV has increased from 76 billion USD last year to 82 billion USD, and it is expected to surpass the hundred billion USD mark by 2025.

The report predicts that from 2023 to 2025, Vietnam and the Philippines will tie as the fastest-growing countries in the Southeast Asian digital economy, with an expected compound annual growth rate (CAGR) of 20%. By 2025, the digital economy scales for these countries are anticipated to reach 43 billion USD and 35 billion USD, respectively. Thailand is expected to see its digital economy GMV grow from 36 billion USD in 2023 to 49 billion USD by 2025, ranking second in size in Southeast Asia.

· E-commerce: GMV reaches 139 billion USD.

The Southeast Asian e-commerce market remains in a high-growth phase, with GMV reaching 139 billion USD in 2023 and is expected to reach 186 billion USD by 2025, representing a 16% growth.

The report indicates that in 2023, e-commerce GMV (Gross Merchandise Value) for Indonesia is approximately 62 billion USD, Thailand is 22 billion USD, Vietnam and the Philippines are both around 16 billion USD, Malaysia is about 13 billion USD, and Singapore is about 8 billion USD.

Adjacent revenues such as advertising and delivery services are engines for the long-term growth of e-commerce. However, user numbers and transaction volume growth are crucial for enhancing profitability.

· Delivery/Takeout: Stable growth, market not fully penetrated.

With the rationalization of competition, the commission rates for Southeast Asian food delivery platforms are now comparable to the global benchmark (rates ranging from 15% to 20%).

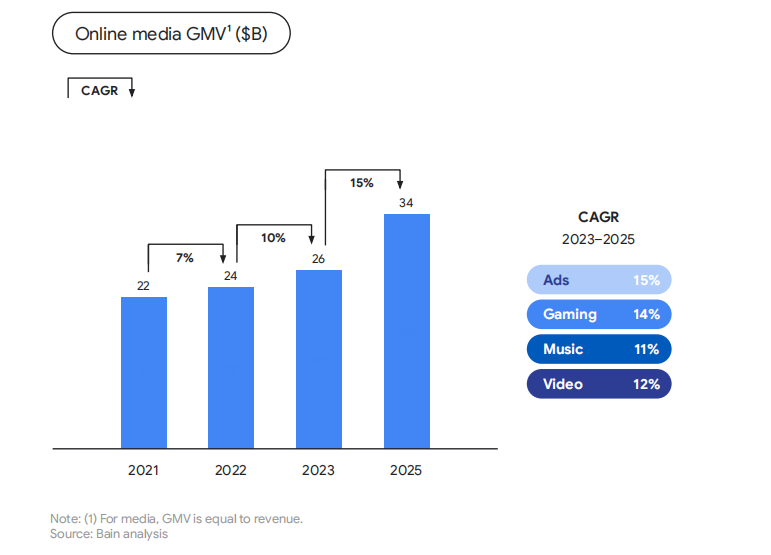

· Online Media: Short videos and advertisements are key growth drivers.

In 2023, the GMV (Gross Merchandise Value) of online media in Southeast Asia increased to 26 billion USD, and it is projected to reach 34 billion USD by 2025. Short videos and advertisements are crucial driving factors for the growth of businesses in this sector.

Among them, casual gaming is becoming a new growth point, with global streaming platforms and short-form video social media competing for users.

· Southeast Asia Digital Financial Services: Cash is no longer king; digital payments account for 50%.

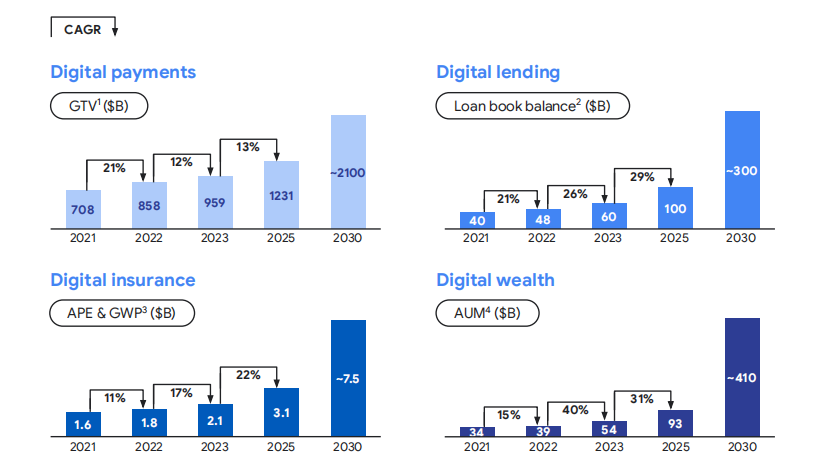

The "2023 Southeast Asia Internet Economy" report points out that Southeast Asian consumers are rapidly adopting Digital Financial Services (DFS), and the shift from offline to online behavior is driving the continued growth of digital financial services.

Southeast Asia's adoption of online payments for individuals and businesses continues to rise, with pure digital payments now accounting for over 50% of regional transactions. Report data indicates that the Southeast Asia digital payment market is expected to grow by 12% year-on-year to reach USD 959 billion in 2023 and is projected to continue growing to USD 1,231 billion by 2025.

Currently, the use of QR code digital payments is widely accepted by Southeast Asian users, and more online payment methods have been integrated into the checkout processes of popular applications.

Southeast Asia Venture Capital: Funding decreases, but reserves increase

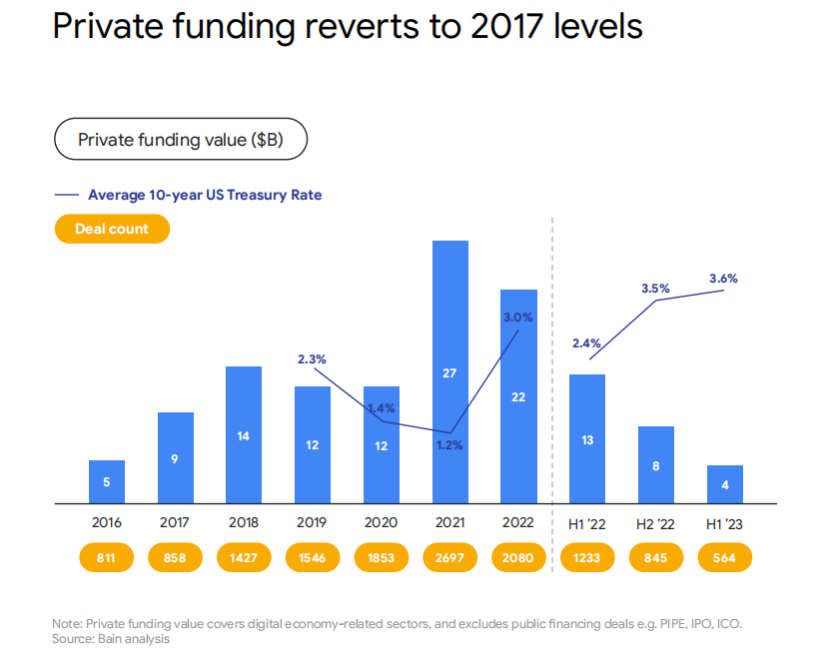

In recent years, Southeast Asia has seen remarkable growth in venture capital. In 2016, Google, Temasek, and Bain predicted Southeast Asia would receive $40-50 billion in investments, leading to a GMV of $200 billion by 2025. In 2022, Southeast Asia had already raised $101 billion, achieving the $200 billion GMV milestone three years ahead of schedule.

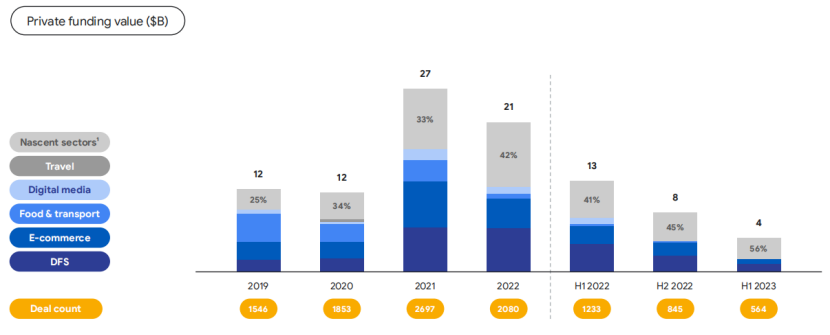

However, compared to past peaks, the financing pace in Southeast Asia has slowed to its lowest point in six years. This slowdown is associated with increased capital costs, and investors are also readjusting their expectations. Nevertheless, a growing trend of investment transactions flows into emerging sectors, indicating that investments are diversifying.

Despite a decrease in financing amounts, the dry powder in Southeast Asia continues to increase, reaching $15.7 billion in 2022.

Overview of the Internet Economy in Key Southeast Asian Countries

Overall, the Southeast Asian region demonstrates strong resilience against global economic headwinds, with consumer confidence showing an upward rebound in the second half of 2023.

· Indonesia: E-commerce Boosts Digital Economy to Surpass a Trillion US Dollars

With the rapid development of e-commerce in Indonesia, coupled with the implementation of various government policies, the Indonesian economy is growing at a rate higher than the Southeast Asian regional average. The digital economy is becoming a crucial component.

Driven by e-commerce, Indonesia's digital economy Gross Merchandise Value (GMV) is expected to reach approximately $110 billion by 2025, surpassing the trillion-dollar mark.

In Indonesia, high-value users in sectors such as tourism, food delivery, gaming, transportation, and e-commerce have an average expenditure that is 6.8 times higher than that of regular users.

· Malaysia: Rapid Development of Digital Payments, Cash is No Longer King

In Malaysia, economic growth is driven by domestic demand, coupled with the rising demand for outbound tourism, which supports the continuous recovery and recent growth of the Malaysian tourism industry.

As QR codes and other forms of digital payments become ubiquitous, cash is no longer king in Malaysia. The government's support for electronic wallets, coupled with the efforts of financial technology companies and financial institutions, has led to the increasing application of other digital financial services such as loans, insurance, and investments.

In Malaysia, high-value users in sectors such as tourism, food delivery, gaming, transportation, and e-commerce have an average expenditure of 5.3 times higher than regular users.

· The Philippines: E-commerce Driving the Development of the Digital Economy

In the Philippines, besides the rising domestic demand, the development of the service industry, including the export of services, is driving long-term economic growth. With the widespread adoption of digital payments, electronic wallets, and account-to-account (A2A) payments are experiencing the fastest growth in the Philippines, particularly A2A payments, which are widely adopted by businesses.

In 2025, the total size of the e-commerce market in the Philippines is expected to reach 24 billion US dollars. Similarly benefiting from the boost in e-commerce, the projected Gross Merchandise Value (GMV) of the Philippine digital economy is anticipated to reach 35 billion US dollars by 2025.